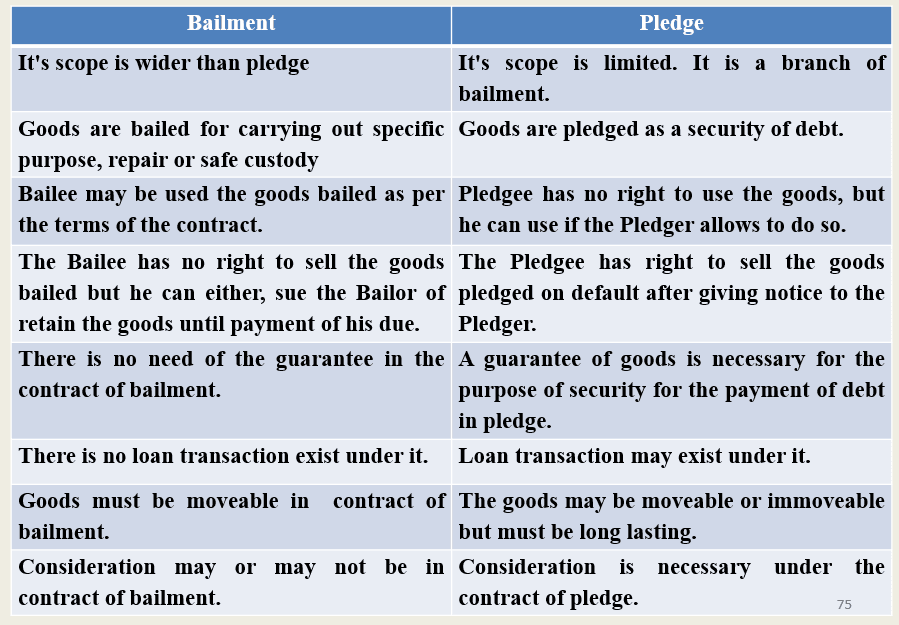

When the owner of goods (the bailor) gives them to another party (the bailee) for a specific purpose, with the understanding that the goods will be returned or otherwise disposed of once the purpose has been completed, this is referred to as Bailment.

As security for a debt or obligation, the bailor (the pledgor) delivers goods to the bailee (the pledgee) in a unique kind of bailment known as a Pledge. If the pledgor defaults, the pledgee may keep the goods until the debt is paid off and, in certain situations, sell them to recoup the money.

Both entail transferring possession, not ownership, and imposing a duty of care on the pledgee or bailee.

Table of Contents

Bailment

The term ‘Bailment’, is derived from a French term ‘Baillior’ which means to deliver or handing over.

A Bailment is the delivery of goods by a person to another for definite purpose, in the condition that after the purpose is accomplished; the goods have to be returned.

Bailment is the change of possession of goods, not a transfer to ownership of goods as in sale of goods.

The common illustrations of bailment are hiring of goods, furniture or cycle etc.

Delivering of cloth to a tailor for making suit, delivering a car or scooter for repairing and delivery dress to dry cleaner are the example of bailment.

Definition of Bailment

“A contract relating to bailment shall be deemed to have been concluded in case any person delivers any property to another person on a returnable basis or for handing it over to any other person or selling it as ordered by him.” Sec.575 GCC 2074

“A bailment is the delivery of goods by one person to another for some purpose, upon a contract that they shall, when the purpose is accomplished, be returned or otherwise disposed of according to the directions of the person delivering them”. Sec. 148 of Indian Contract Act, 1872

Features of Bailment

- Special Contract

- Delivery of moveable goods

- Delivery for some special purpose

- Non-transfer of ownership

- Return or dispose of goods

- Consideration is not necessary

Kinds of Bailment

On the basis of Benefit

- Bailment for the exclusive benefit for Bailor e.g. safe custody of goods without any charge.

- Bailment for the exclusive benefit for Bailee e.g. Delivery of Motorcycle to a friend to go somewhere.

- Bailment for the benefit for Bailor and Bailee e.g. Delivery of Motorcycle to repair.

On the basis of Reward

Gratuitous Bailment: bailment without remuneration

Non-Gratuitous Bailment: bailment with remuneration

On the basis of Formation

- Expressed bailment: by verbal or written form

- Implied Bailment: By Conduct :

Rights of Bailor

Rights of Bailor: The person who delivered the goods.

Enforcement of Bailee’s duties:

- Rights to demand to return goods in the prescribed time.

- Right to claim any natural increment.

- Right to claim damages for loss by Bailee’s negligence.

- Right to claim compensation for any damage arising from or during unauthorized use of goods.

- Right to claim compensation for any loss caused by unauthorized mixing of bailed goods with his own goods.

Right to termination a Contract of Bailment

- If the objectives of the contract can not be fulfilled.

- If the contract has an illegal object.

- If the Bailee breaches the terms of the contract.

- If the contract has a fraudulent object.

Duties of Bailor

- Duty to provide any fee or charge for Bailment

- Duty to disclose known defects of goods

- Duty to repay necessary expenses

- Duty to indemnify bailee

- Duty to receive back the goods

Rights of Bailee

Rights of Bailee: The Person to whom delivered the goods

Enforcement of bailor’s duties

- Right to claim damages for loss arising from the non disclosed faults in the bailed goods.

- Right to claim reimbursement for extra-ordinary expenses incurred in the bailed goods.

- Right to indemnity for any loss suffered by him by reason of defective title of the Bailor to the bailed goods.

- Right to claim compensation for expenses incurred for the safe custody of the goods if the Bailor has wrongfully refused to take delivery of them after the term of bailment is over.

Rights to deliver goods to one of several joint Bailor:

If there are several bailor, bailee can deliver goods to one of several joint bailor.

Right to lien:

The right to possession of the property or goods belonging to another until some debt of claim is paid is called the right of lien. The Bailee may enjoy the right of special lien to the bailed goods.

Right to deliver goods in good faith to the untitled Bailor:

The Bailee may deliver the bailed goods to Bailor, he should not be responsible to the real owner of the goods.

Right of general lien:

A Bailee can keep any kind of goods of the same Bailor in his possession until the full payment of necessary charges

Duties of Bailee

- Duty to take reasonable care of goods delivered to him

- Duty not to make unauthorized use of goods of bailment

- Duty not to mix bailed goods with his own goods

- Duty to return the goods

- Duty to deliver any accretion (increment) to the goods

- Not to set up adverse title

Termination of Bailment

- Termination of bailment means the bailment comes to end and the legal relationship of the parties is no longer remain. There are various circumstances where contract of bailment is terminated. General Civil Code 2074 has laid down some legal provisions in respect of the termination of bailment. A contract of the bailment is terminated as follows:

- On the expiry of specific time period.

- On the accomplishment of specific purpose.

- Inconsistent act with the term.

- On the destruction of subject matter of the contract of the bailment.

- On the void condition of the contract.

- A gratuitous (Without charge) bailment: It can be terminated by the Bailee at any time.

Finder of Lost Goods

- The term finder of lost goods means a person who has found goods not belonging to him and keeps them with him. The responsibilities of the finder of lost goods as same as the Bailee.

- According to the section 71 of Indian Contract Act, 1872; A person who finds goods belonging to another person and takes them in to his custody, he is subject to the same responsibility as Bailee.

- Rights and duty of finder of lost goods:

- Right to retain possession of the goods until the true owner is found

- Right to lien over the goods for expenses

- Right to sue for reward

Right to sale:

- If true owner cannot be found or if he refuses upon demand to pay lawful charges of finder, the finder may sales the goods in the following conditions:

- When the owner refused to pay the expenses incurred by him.

- When the things is in dangerous nature or losing the greater part of its value.

- When the lawful charges of the finder in respect of things found amount of two third of its value.

- The true owner however is entitled to get surplus left after reimburse the lawful charges of the finder.

Duties of the finder of lost goods

Duty to take reasonable care of the goods as like Bailee

- To take necessary care of the goods

- Not to use for personal purpose

- Not to mix with his own goods

Duty to find out true owner

It is duty of the finder of lost goods to make efforts to find the true owner of the goods,

if the finder of lost goods fails in his duty he should inform the police about this.

Pledge or Pawn

- Loan transaction is very familiar in business operation. Pledge or pawn provides security for repayment of such loan.

- The Pledge is also a kind of special contract and a part of bailment. The bailment of goods as security for payment of a debt is called pledge.

- It is a transfer of goods as security for the payment of debt or performance of the promise.

- The goods deposited as security to repay the debt or to perform them the promise is known as pledge.

- The term pawn is synonymous to the term pledge. e.g. ‘A’ takes Rs. 20 thousands from ‘B’ and keeps his golden chain as security for payment of debt. The bailment of chain is Pledge. ‘A’ is Pledger and ‘B’ is Pledgee.

Features of Pledge or Pawn

- Delivery of goods

- Delivery for Security

- Lawful purpose

- Return of goods

- The goods may be moveable or immoveable but must be long lasting

- An agreement between Pledger and Pledgee.

Advantages of Pledge or Pawn

- It provides the security for repayment of loan.

- It helps to accumulate the capital to carry out any business activities.

- It makes the easy way to recover the loan.

- It helps to fulfill the respective obligations of parties.

- It helps to reduce the conflicts between the parties.

- It creates the opportunities for loan transaction.

- It help to flourish the business activities.

- It helps to develop the business sectors.

- It helps to secure the social security.

- Ultimately, it helps to growth national economic.

Pledged by Non Owner

- Generally, pledged can be made by the true owner of goods. Exceptional Rules are as follows;

- Pledge by mercantile agent

- Pledge by person in possession under voidable contract

- Pledged by person having limited interest and right

- Pledge by buyer in possession of goods under an agreement to sale

- Pledge by co-owner in possession

- Pledge by the seller of the goods after sale

Right and Duties of Pawner

Rights of Pawner

- Enforcement of Pawnee’s duties

- Right to get back pledged goods

- Right to receive notice before sale of pledged goods

- To receive the goods with accretion

Duties of Pawner

- To compensate the extra-ordinary expenses incurred for necessary care of the goods.

- To pay of the dues, if it is inadequate by the sale of the goods

- To disclose the facts of defect of the goods

- To meet his obligation on stipulated time

Right and Duties of Pawnee

Rights of Pawnee

- Right to retain continuous possession

- Right to claim extra-ordinary expenses

- Right to sell the goods on default of the Pawner

Duties of Pawnee

- To take reasonable care of the goods

- Not to make any unauthorized use of the goods

- Not to mix the goods pledged with his own goods

- Not to do any act in violation of the terms of the contract of pledge and the provisions of contract Law.

- To return the goods after the received the full dues or fulfillment of promise of the Pawner

- To deliver any accretion to the goods to the Pawner

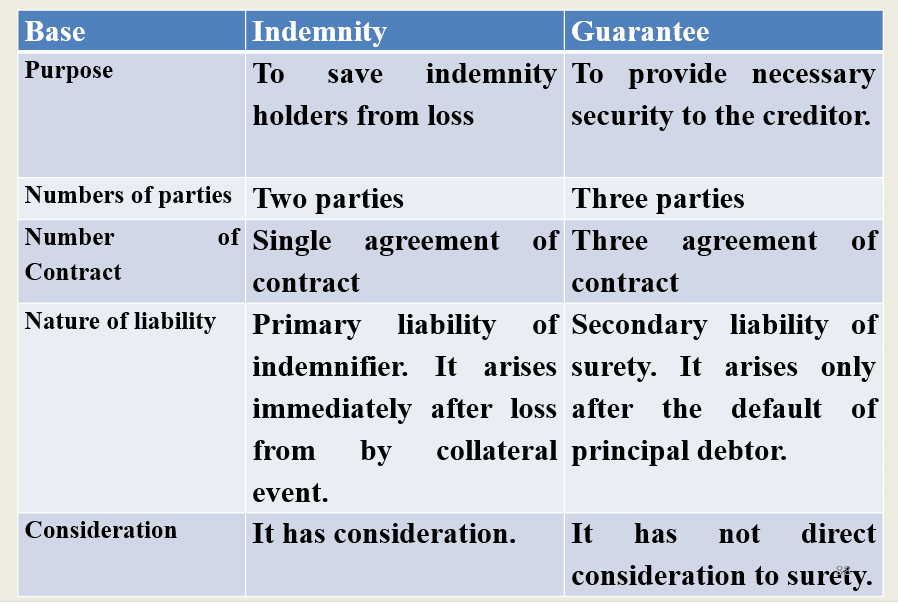

Indemnity

- To indemnify means to compensate or to recover the loss.

- Contract of indemnity means a promise or statement of liability to pay compensation for loss or wrong in transaction.

- Indemnity is a security or protection against a contingent hurt, damage or loss.- Dictionary of Garner on Modern Legal Usage

- Where any person has concluded an agreement relating to indemnity with the provision to pay for any party or third person for any loss or damage that may result from his actions, while working under the direction of party to that contact, he may realize as compensation.

- A contract by which one party promises to save the other from loss, caused to him by the conduct of the Promisor himself or by the conduct of any other person, is called a contract of indemnity.- Sec. 124 of ICA, 1872

Features of Contract of Indemnity

- It is a special contract

- Necessary to be all essential elements of valid contract.

- It is a contingent contract.

- All matter depends on the agreement of the contract.

- A contract of indemnity is a security for loss.

- It covers the concerned party as well as the third party.

- It may be made expressly or impliedly.

- It covers only the loss caused by an event mentioned in the agreement of contract.

- It covers only the actual loss.

- It has two parties. Indemnifier and Indemnity holder.

Right of Indemnifier

The person who promises to recover for contingent damages is called an Indemnifier.

- Generally, duties of an indemnity holder are the rights of an indemnifier.

- Indemnifier does not liable for loss caused by the negligence of Indemnity holder.

- Indemnifier does not liable incase Indemnity holder Work with intention of causing any loss or damage.

- Indemnifier does not liable incase Indemnity holder work against the instruction of indemnifier.

- Indemnifier does not liable incase Indemnity holder Work against the terms of contract.

Duties or Liabilities of Indemnifier

Generally, rights of indemnity holder are the duties or liabilities of an indemnifier. The duties and liabilities of Indemnifier are as below;

- Duty to pay all damages for Indemnity holder.

- Duty to pay damages to pay for third party any loss.

- Duty to pay all costs relating to indemnity.

- Duty to pay all costs of legal actions.

Right of Indemnity holder

The person who has right to recover for contingent damages is called the Indemnity holder.

The indemnity holder is entitled to recover any or all of the amounts of compensation under the contract of indemnity.

The rights of Indemnity holder are as fallows:

- To recover entire indemnity amount prescribed in the agreement of contract.

- To claim all damages compelled to pay to third party for loss

- To claim all costs spent in relating to indemnity.

- To claim all the costs of legal actions.

Duties of Indemnity holder

Generally, the rights of Indemnifier are the duties of Indemnity holder.

But, except otherwise mentioned under the contract, indemnifier does not be liable for the loss in the following circumstances,

- Not to work negligently.

- Work without the intention of causing any loss or damage.

- Not to work against the instruction of the promisor or indemnifier.

- Work in according with agreement of contract.

Contract of Guarantee

A “Guarantee” means a contract of a promise to be responsible for something, to perform the promise or to discharge the liability of a third person, incase of his default. Such a contract involves three parties.

- Creditor: The person, who makes certain promises and to whom the guarantee is given.

- Surety: The person, who gives the guarantee.

- Principal Debtor: The person, in respect of whose default is given the guarantee, is called the principal debtor.

Definition of Contract of Guarantee

A contract relating to guarantee shall be deemed to have been conduct if it provides that, if any person defaults in the repayment of the loan obtained by him or fulfillment of the obligation accepted by him, It will be repaid or fulfilled by a third person. (Sec.585 GCC 2074)

A contract of guarantee is a contract to perform the promise to discharge the liability of a third person in case of his default. Sec. 126 of ICA 1872

Features of Contract of Guarantee

- A tripartite (tri-party) contract:

- Under the contract of guarantee, there must be the three parties. Principal Debtor, Surety and Creditor are party of contract of guarantee. There should be three different agreement between three parties.

- No direct Consideration between Surety and Creditor:

- Primary liability lies upon the principal debtor and surety seems to be secondary or conditional liability.

- Liability of Surety arises after the defaults of principle debtor.

- It must be concluded in written form.

- Consent all of three parties is essential.

- other essentials elements of valid contract.

- Besides that, being special contract, it must satisfy all the essential elements of valid contract such as offer and acceptance, lawful objective, consideration, free consent, contractual capacity etc.

Types of Guarantee

- Absolute and Conditional Guarantee: Unconditionally a promise to pay the debt, on the default of the principal debtor, is called absolute but, if some contingency arises there is a conditional guarantee.

- General and Special Guarantee: Accepted by general people is called general guarantee and accepted by a particular person is called the special guarantee.

- Limited and unlimited Guarantee: If there is limitation of time and amount under an agreement is called the limited guarantee, whereas there is not any limitation of time and amount is called the unlimited guarantee.

- Prospective and Retrospective Guarantee: Guarantee is given for future transaction is called prospective guarantee and Guarantee is given for past or existing actions is called retrospective guarantee.

- Specific and Continuing Guarantee: Guarantee is extended to a single transaction or debt is called a specific guarantee and if a guarantee extends to a series of transactions continuously is called a continuing guarantee.

Features of Continuing Guarantee:

- Continuing Guarantee is not ended by the first advance.

- It is always be revoked by a notice to the creditor.

- A revocation of continuing Guarantee is possible for future transactions.

- Death of the surety terminates the contract.

Revocation of the Continuing Guarantee

- By Notice: A Surety may revoke a continuing guarantee at any time by a notice.

- By death of Surety: The death of the surety automatically terminates the contract of guarantee. But except otherwise agreed, the liability of the surety for the previous transactions is not discharged.

- By the variation in the terms of the contract without the consent of surety.

- By novation of the contract.

- By discharge of the principal debtors.

- By loss of security

Rights and Liability of Surety

Rights of Surety

- Rights against the creditor

- Rights against the Principal debtor

- Rights against co-sureties

- Rights to recover actual paid amount

Liabilities of Surety

- Secondary liability of surety

- Contingent nature of liability

- Limited nature of liability

- Liability co-extensive as the principal debtor

Primary liability of Surety

- If the principal debtor is the minor.

- The principal debtor becomes insolvent.

- Operation of law occurs; death and insanity of principal debtor

- But it depends on the agreement of the contract.

Discharge of Surety from the liabilities

- By performance

- By revocation of Surety

- By discharge of principal debtor

- By release of principal debtor

- Discharge by variation in terms

- By compromise of creditor and principal debtor

- By loss of security

- By the discharge of one of the surety

- By expiry the time etc.

Frequently Asked Questions (FAQ)

What is Bailment?

In a Bailment contract, one party (the bailor) delivers goods to another (the bailee) for a specific purpose with the understanding that the goods will be returned once the goal has been accomplished or disposed of in accordance with predetermined guidelines.

What is a Pledge?

A pledge is a unique kind of bailment in which products are given as collateral for a loan or debt with the understanding that they will be returned once the debt is paid back.

Is consideration necessary for bailment or pledge?

No, both can be made without consideration, but there must be mutual consent.